Final

Deadline

April 16, 2026

Judging

Date

May 18, 2026

Winners

Announced

June 10, 2026

The founder of Lingua Franca, Larry Stone MS, spoke lovingly about the “layers of flavor,” the great “finesse,” and the “mineral aspects” of Eola-Amity Hills pinot noir, which makes wine from this Oregon appellation “compelling.” He started the company in 2012 after a long career in wine.

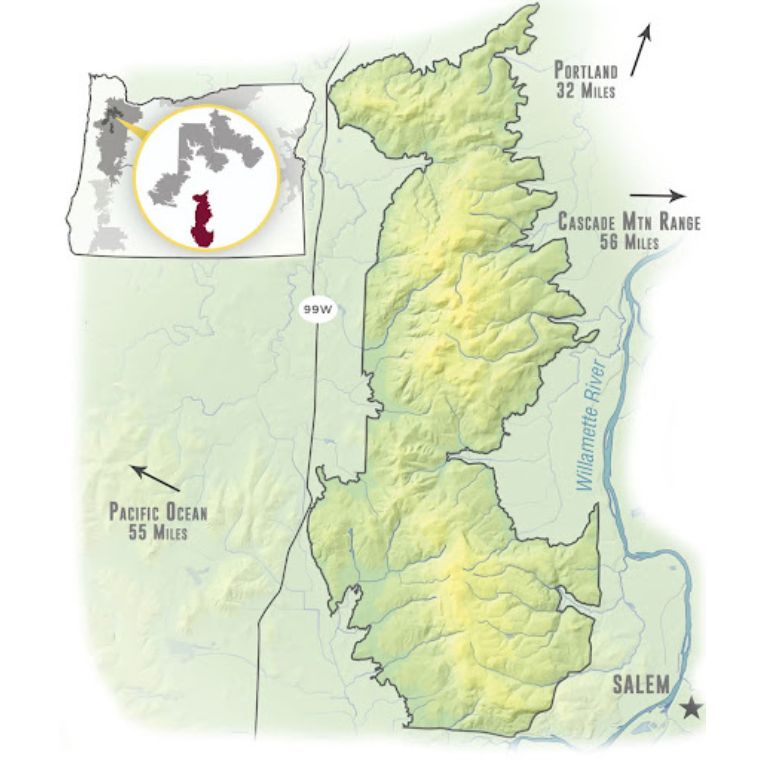

The American Viticulture Area (AVA) he spoke of lies nested inside the much larger Willamette Valley AVA, near Portland, Oregon. A Master Sommelier, Stone concluded that these superb qualities, linked to a distinct terroir, make Eola-Amity Hills wines “extremely interesting and appealing to a wide international audience.” Indeed, by 2020, dozens of states and 60 international markets carried the Lingua Franca brand, including strong markets in Europe and East Asia. “I think for one who likes Burgundy this is the best place in the world to grow outside of Burgundy.”

Eola-Amity Hills AVA Source: Eola-Amity Hills

Lingua Franca’s story presents a microcosm of the changes affecting the Oregon wine industry, which reflects major trends nationwide. Coming from California, Stone bought the vineyards and created a vinous powerhouse within eight years. As the Lingua Franca website explains, renowned Bourgogne winemaker “Dominique Lafon took notice of this exceptional vineyard site and joined Larry Stone, alongside winemaking protégé Thomas Savre, to craft uniquely expressive wines harnessing the unique terroir of Oregon.” The crusader of regenerative viticulture, Mimi Casteel, pitched in to help Stone as well. Bourgogne wine producers had in fact taken an interest in Oregon going back three decades when the prescient Domaine Drouhin invested in the Valley, but most Oregon wine producers remain small and quality-oriented.

In spring 2022, however, Stone sold Lingua Franca to wine and spirits giant Constellation Brands. This is a Fortune 500 company, with brands including Robert Mondavi (acquired in 2004) and its subsets (alongside Coors and Modelo beer). Constellation, too, had implemented strategic shifts in business strategy. The New York State-based company sold most of its “value-oriented” brands to California’s E & J Gallo in 2021 while reorienting towards premium and luxury markets, holding, for example, To Kalon Vineyard Company, The Prisoner Wine Company, Mount Veeder, and Schrader Cellars in its new Aspira Fine Wine & Craft Spirits portfolio. Lingua Franca joined the Aspira roster, which is a standalone, vertically integrated fine wine and craft spirits division formed the same year. Constellation reported results from its fiscal quarter ending Nov. 30, 2023: Net income was $509 million, up 9% annually, on net sales of $2.47 billion, up 1% from the prior year.

And now, the President of Aspira, Robert Hanson, who Stone praised as a visionary committed to sustainable production, is leaving Constellation. “Robert has been instrumental in leading the charge to reposition our Wine & Spirits business to a higher-end portfolio of brands more aligned with consumer trends, with an expanded focus to include global, omnichannel distribution, with more robust and targeted international and direct-to-consumer sales channels,” Constellation said in a news release.

Therefore, today, the questions are:

- “What are the defining characteristics of the Oregon Wine Industry that set it apart from other U.S. wine regions?”;

- “What are the challenges and opportunities the industry faces?”; and

- “What trends in the global wine industry are impacting it on the local level?”

I grew up in Oregon from the mid-1960s through the mid-1980s and witnessed the early emergence of Oregon wine as a product to be taken seriously, at least in Oregon. Pioneers such as Erath Winery produced extraordinary wines from what was then considered a beyond-marginal cool climate growing area. These early experimenters started in the mid-1960s and by the early eighties people in Portland and Eugene knew about Oregon pinot noir. They bought it. David Lett of Erath and Charles Coury “laid the roots of winemaking legend in the Willamette Valley,” says Oregon Wine. These were small winemaking operations with local markets. In many ways that still characterizes much of the industry.

Image Source: Oregon Wine Board

Although the fame of Oregon wine has spread worldwide among enthusiasts, a large percentage of overall sales are direct-to-consumer (DTC). Tasting room programs are critically important. There is an Oregon wine business culture, an ethos, that prioritizes small-scale and family enterprises. It’s a uniform characteristic of Oregonians, both consumers and producers, that has been passed on to those who move there.

Currently, seventy to seventy-five percent of Oregon wineries make 5000 cases of wine or less. In 2018, 64% of production was Pinot Noir, however with the caveat that at least 72 wine grape varieties are grown in the state, whose 23 AVAs now extend well beyond the Valley. There is increasing diversity. While pinot noir, because of the quality Stone spoke about, remains predominant in sales, exciting changes are taking place, as described below.

Eco-friendly wine production currently goes hand-in-hand with the emphasis in the Oregon wine economy on small-scale production. Fifty-two percent of Oregon wine grapes are from estate-grown fruit; 47% of growers are certified sustainable by LIVE, a Pacific Northwest certification that is comprehensive in scope, securitizing all integrated aspects of business operations, including human resources.

A host of other certifications are taken to heart by many wineries, including Salmon Safe and Oak Accord, which help protect biological diversity and natural habitats. As Bree Stock MW recently put it, no “monoculture of the vine” exists in Oregon, which has strong farming traditions.

Oregon produces one percent of the fine wine in the US, yet 52% of the Demeter-certified wineries in the country are in Oregon alongside a large percentage of the B Corp wineries. Most vineyards feature sloped aspects, meaning that most grapes are hand-harvested, generally 2 ½ to 3 ½ tons per acre in the Willamette Valley. Hand labor is costly, although there is little need for irrigation, which provides some cost savings for those looking to start out in the industry. Prices for pinot noir and increasingly chardonnay grapes can be relatively high, which is justified.

Despite those who warned in the 1960s that Oregon was much too cool to produce quality wine, it lies on the 45th parallel, with 15 hours of sunshine during the summer peak and good diurnal variation, which can vary by the AVA. A majority of the state’s 23 AVAs lie within the Willamette Valley; other significant regions include the Umpqua and Rogue Valleys in southern Oregon. In 2018, there were an average of four new vineyards opening a month.

The head of Silicon Valley Bank’s wine division and author of the State of the Industry Report, Rob McMillan, told me: “Oregon is pretty much the last industry region standing that still has modest (though declining) growth. I attribute that to many things but value and taste profile are the top two.” He added that “Oregon Wine also can take some bows for the work they’ve done.” This definitely bucks the overall trend, partially because of Oregon’s focus on the premium and luxury segments as well as, I believe, considerable support from local buyers, including on-premise. The question is, can the current situation sustain growth?

What’s new and coming in 2024 for Oregon wine? One is the diversification beyond pinot noir while still maintaining high quality. Chardonnay is the most prominent example, but that is joined by sparkling wine production. This goes beyond just varietals to increasing clonal diversity, backed by research. The popular sparkling category is seeing a notable upsurge, including experimentation with varietals beyond those typical to Champagne. This market has growth potential. Another successful variety is gamay noir which retains its vital acidity in most Valley terroirs. Pinot gris production is plateauing; it was popular two to three decades ago but has not met the expected success. One producer is even experimenting with gouais blanc, the French parent of dozens of varieties. McMillan observed that Oregon's “acreage seems balanced based on data lagging up there by a year.”

Oregon is also continuing to lead in increasing holistic sustainable practices, including regenerative viticulture focused on carbon capture in vineyard soils, spearheaded to a large part by the efforts of Stone’s friend Mimi Casteel and the Regenerative Viticulture Foundation.

In terms of challenges, climate change concerns, market saturation, and the potential impact of consolidation on Oregon’s beloved small-scale producers lie in the crosshairs. Oregon’s demonstrated commitment to sustainable and eco-friendly production methods speaks to confronting the climate change issue, as does the highly educated and experimental nature of many winegrowers. Most will adapt to climate change successfully. Climate scientist Greg Jones recently said: “Back in the 60s and 70s, we were on the cooler limits of pinot noir suitability. Today we’re centered within that suitability. So a few degrees of warming has put us into a much more goldilocks, for lack of a better term, framework. We’re the sweet spot, so to speak.” He continued: “It’s a little bit different in the Willamette Valley, which is a little bit cooler and wetter than parts of southern Oregon or eastern Oregon. But in general, the entire state has become more suitable [for wine grape production] since the 1960s, when we first started.”

Can small producers maintain the balance between price points and the need to increase sales and profitability? One Oregon restaurant owner and sommelier, Kelsey Glasser, recently commented: “In Oregon, we are surrounded by amazing Pinot Noir but unfortunately, none of it is what you’d call ‘budget wine.’” She isolated one exception: Soter’s Planet Oregon Pinot, emphasizing a common selling point, that it is “farmed sustainably.” “They manage to capture that quintessential Willamette Valley Pinot style of spicy red fruit,” she said. Her comments spell out a concern going forward regarding premium pricing and the capacity of premiumization to continue. Technical and financial solutions will have to be sought, which could include consolidation for some.

Image Source: Oregon Wine Board

Constellation Brands is now there, as is Drouhin and Jackson Family Wines. There are other relatively large companies like King Estate. King acquired 70 acres of grapes at nearby Pfeiffer Vineyard in 2022. Consolidation, as it is everywhere, will continue to be a factor in the Oregon wine industry. In 2021, Michelle Wine Estates (Chateau Ste. Michelle) announced the acquisition of A to Z Wineworks, one of the state’s iconic wineries. Ste. Michelle's was, in turn, purchased by private equity firm Sycamore Partners for $1.2 billion cash in July 2021. Distributors too are consolidating.

The “Wine Economist,” Mike Veseth, wrote in 2022: “It is easy to see why distributors might favor large wine companies with broad portfolios. Big favors big, which favors big. Evolutionary forces point towards increased concentration, even in an industry as fragmented in some ways as wine. To a certain extent, then, wine consolidation is the result of a process (accelerated by the Covid channel shifts) that is affecting retail more generally. Consolidation, in this view, starts at the retail level and works its way backward.” Small Oregon producers have to maintain alternative sales channels, be absorbed, or the 2018 trend of four new vineyards a month will go retrograde.

Consolidation, of course, is not necessarily bad and speaks to market realities, including premiumization. Experts contend that many large companies find they must adapt to Oregon’s wine industry ethos to succeed there. And that appears to hold up. One could also compare Oregon to Napa and Sonoma in the 1980s and 1990s, although I believe that total “Napa-ization” of Oregon’s wine industry will not occur. Oregon has developed distinctive business clusters and small business cultures with their own way of making profits, and there are few who can deny that wine quality remains superior, thus the cautious but positive tone of Rob McMillan’s assessment.

[[relatedPurchasesItems-61]]

- Increasing exposure to international markets will be a factor for producers looking, either by choice or by necessity, to grow into medium-sized enterprises. The British market holds potential, as does East Asia and Central American metro areas.

- Experiential DTC sales, offering value-added like education, wine clubs, educated staff, etc. will remain important as will direct shipping, backed by efficient marketing, including social media.

- Continued emphasis on sales to the on-trade will be critical, including expanding marketing to higher-end restaurants in neighboring states and major US metro areas.

- Wineries should reach out not only to small and medium-sized distributors but also to US sommeliers; and educate them.

- Industry and political support of the Oregon Wine Board must continue as should academic research and education at places like Oregon State University and the Linfield University wine studies program.

So, Oregon reflects the national trends, but with a solid cultural underpinning making small production still financially viable, with plenty of opportunity on the horizon for adept entrepreneurs like Larry Stone.

Note - Header Image Source: Oregon Wine Board

Enter your Wines now and get in front of top Sommeliers, Wine Directors, and On-Premise Wine Buyers of USA.