Final

Deadline

April 16, 2026

Judging

Date

May 18, 2026

Winners

Announced

June 10, 2026

Regional, state, and national wine associations can play a pivotal role in helping the wine industry navigate obstacles through a combination of local expertise and insightful analysis of broader national and international trends. By all accounts, since its foundation in 2003, the Oregon Wine Board and its staff of eight have navigated that task admirably. The state wine agency commonly goes by the name “Oregon Wine.” Now it has new leadership. Gina Bianco started as executive director in February 2024, alongside three new board members, representing a third of the total board.

Bianco emphasized the importance of establishing “a long-term vision that supports, represents, and celebrates the diversity and interests of the Oregon wine industry locally, nationally, and internationally.” She hopes Oregon Wine can “engage winegrowers, winemakers, and regional associations” in developing a new 2025 strategic plan. The mandate must tackle what the Board, in an interview, correctly terms “the state’s diverse wine growing regions” in the areas of “marketing, research and education initiatives” that support both the “wine and wine grape” industries. Indeed, Bianco came from a position as executive director of the Rogue Valley Vintners Association in Southern Oregon, far from the Willamette Valley where the vast majority of Oregon wine originates. The Rogue River Valley is distinguished by small, independent producers.

Gina Bianco. Source: Oregon Wine

Before publishing the somewhat gloomy 2024 SVB Wine Industry Report, Tob McMillan told me that Oregon Wine “can take some bows for the work they’ve done” in maintaining growth. In an interview Oregon Wine contrasted the overall “global market” with “bulk wine production and global brands,” “both experiencing a significant decline in sales performance” with “wine regions which rely on relatively small scale production, premium site selection, harvesting and winemaking methods.” These “continue to see sales growth,” and Oregon’s industry falls definitively into those latter categories.

“Oregon wine producers are seeing their sales continue to grow” owing to several factors.

- “A move towards growing more familiar grape varieties, such as Pinot Noir and Chardonnay makes the wines more accessible.”

- “The wines are typically made using low intervention, sustainable practices” resulting in “high-quality wines that are naturally able to command a price premium. This is a growing segment across all wine markets.”

- The state’s climatic conditions create wines that “have a great balance between acidity, body, and alcohol. Consumers understand this and are increasingly moving towards wines with a lower alcohol ABV and more rounded profile (a key trend here is consumers recognizing and choosing wines” from cooler regions.

Norman Comfort, who handles marketing Oregon wines in the United Kingdom, said: “Consumers are increasingly looking to understand more about the wines they buy and consume. They want to understand the story behind the brand and the way the wine is made. Oregon has a significant legacy of pioneering wine production, keeping a focus on quality and sustainability for future generations to inherit, and maintaining a family spirit at the winery. These values are critical to a new wave of customers who value this and are prepared to pay a premium for brands they can legitimately believe in.” Oregon Wine, therefore, has embraced premiumization while representing a diversity of predominantly small, but also some very large, wine producers.

Oregon Wine provided some rosy statistics for 2022. We will see if 2023 has kept up the pace, though indicators are positive.

- Total wine grape production in 2022 increased nearly 20% over 2021 from 114,677 tons to a record 137,065 tons.

- Harvested acreage increased by 4% from 2021. Yield per harvested acre in 2021 increased by 15% over 2021.

- The estimated value of wine grape production in 2022 increased by 22% or by $58.7 million to about $330 million.

- Based on grower data one estimate says that between 35% and 40% of planted Oregon acreage is certified sustainable or organic (including but not limited to USDA Organic, Biodynamic, Deep Root Coalition, LIVE, etc.)

- Case sales increased 8% across all channels from 5.3 million to 5.7 million cases in 2022.

Northwest wine expert Sean Sullivan recently reported: “Oregon’s 2023 growing season was marked by a cool start, subsequent warm temperatures, a very dry summer, and, in many cases, a compressed harvest. Quality looks to be high. Some wine producers are positively giddy.”

Is there a secret to Oregon Wine’s success? The interview continued: “Oregon Wine Board is particularly effective in coordinating consumer-driven activity with the trade and logistics side of the wine industry. Alongside engaging consumers and helping them to understand more about the Oregon wine region, its unique characteristics, and grape varieties, the Oregon Wine Board has a longstanding and deep commitment to comprehensively supporting the industry. This involves strategic partnerships with tourism boards and businesses, investing in local tasting rooms and promoting wine tours of the region, supporting a dedicated export department that has the knowledge and expertise to facilitate international sales, and a supply chain partnership program.” In its key international markets of UK, Europe, and the Far East, Oregon Wine “supports marketing initiatives covering consumer, education, and trade aspects.”

“Looking at the UK as an example, the Oregon Wine Board has invested in London Restaurant Festival (to match specific food menus in premium London restaurants with Oregon wines)” and engaging the Wine & Spirit Education Trust to create “an education program” with “Oregon masterclasses, alongside trade tastings and sommelier training.”

[[relatedPurchasesItems-61]]

Responding to a question about the five most important challenges facing Oregon winegrowers over the next five years, Oregon Wine listed:

- Climate change

- Emerging wine regions

- Increased costs within the supply chain of the wine industry

- A wider trend of consumers drinking less wine, less often

- political intervention that, in several different ways, may discourage wine production

Comfort said, “Oregon can continue to make high-quality wines as the climate changes. By creating sub-AVAs such as Dundee Hills and Eola Hills they can illustrate how ocean influence, altitude, and soil also positively impact local terroir.” Indeed, some reports indicate Oregon is currently in a climate “sweet spot.” But will that last?

Regarding competition from emerging wine regions, Comfort intriguingly used “English wines as an example.” He said, “Oregon can continue to highlight its legacy and 60-year wine-making heritage. By definition, it also has older vines which give a natural advantage in wine making. While Oregon does have a ‘first mover advantage,’ it also has contemporary wine styles and strong brands that resonate with consumers and give a modern feel to Oregon wine.”

“The majority of Oregon wine continues to be sold in the local market. International sales build credibility and illustrate the world-class nature of these wines. As exports increase and digital channels become more mainstream, consumers and customers understand that these costs are legitimate. Winemakers often highlight the ex-cellar door prices and separate delivery costs to highlight this.”

One of the most troubling aspects of the current wine market is a wider trend of consumers drinking less wine, less often. “Amongst these concerns and considerations, quality is nearly always the deciding factor when consumers choose to drink wine. By communicating the focus on the quality and sustainability of their wines,” Oregon wines convey a premium message “and fit within the repertoire of wines consumers choose from.”

Currently a very hot topic, political intervention could—and is— discourage wine consumption and hence, production. “The Oregon Wine Board has a strong relationship with the government and understands the role of winemaking within a broader agricultural industry. It works hard to maintain robust relationships with the government by sharing stories about the economic output and benefits of the winemaking industry in Oregon. This includes local trade, tourism, employee numbers, supply chain beneficiaries, etc.”

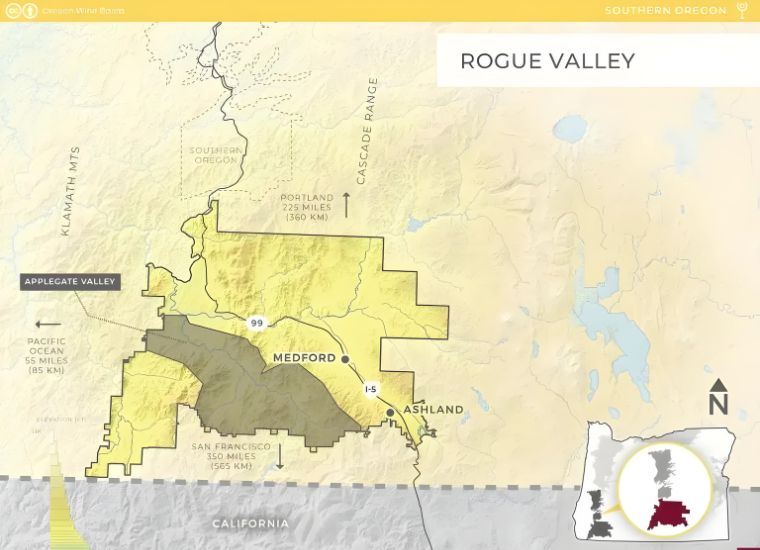

Rogue Valley, Oregon. Source: Oregon Wine

In the end, is Oregon’s wine glass half full or half empty? Gina Bianco will say half full, and getting fuller. She has a challenging market environment to navigate. Based on her experience in the much smaller region of Rogue River, Oregon Wine Board Chair Dr. Greg Jones said: “We recognize Gina’s high level of integrity, ethics, and transparency, and her ability to encourage open communication among winegrowers and winemakers across our state.” Justifying the choice of Bianco, he continued: “We felt Gina could come to OWB well-equipped with a positive track record and will serve our state well as we elevate Oregon wine’s profile. She’s an energetic and effective leader and can bring diverse groups together to discuss and resolve issues.”

The Oregon wine industry will indeed be interesting to watch in 2024.

Header Source: Oregon Wine. Photo by Carolyn Wells-Kramer (Updated July 24, 2024)

Enter your Wines now and get in front of top Sommeliers, Wine Directors, and On-Premise Wine Buyers of USA.